The 3x growth of local product searches most retailers are missing out on

This is Part 4 in our series of posts tracking how the pandemic is changing the way shoppers find products locally. Each month the NearLIVE platform captures over 3 billion local data points covering almost every retail vertical, which reveals a rapidly evolving set of shopping habits. See the other posts in the series at near.st/blog

COVID-19 has fundamentally changed the way we all shop. In this post we outline how shopper behaviours moving online shouldn’t be equated with buying online. We reveal our data that shows a 3-fold increase in the volume of people going online to find products in their local shops, and what retailers can do to capitalise on this today.

We all know more people are buying online

With brick-and-mortar stores closed for April and much of May millions of customers shifted behaviours online, driving a massive spike in ecommerce sales. Once physical shops were allowed to re-open, the spike dropped but to a new higher level.

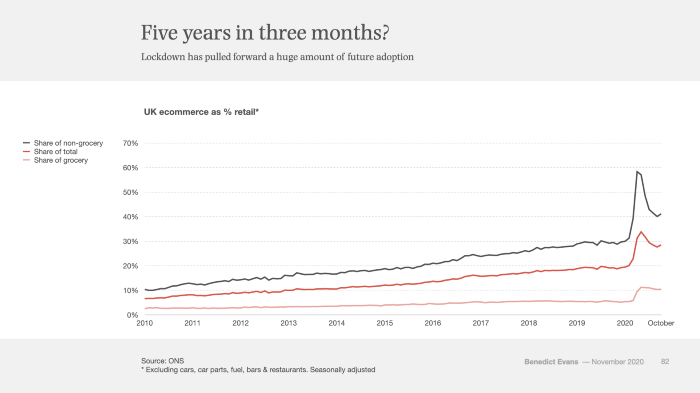

Benedict Evans highlights this, describing the sustained jump as five years growth in three months:

- Ecommerce grew from 20% to 28% (+40%)

- Non-grocery ecommerce grew from 30% to 40% (+33%)

- Grocery ecommerce grew from 5% to 10% (+100%)

For brick-and-mortar retailers, these sudden and sustained shifts in shopping behaviour online can seem scary. Our data, though, show that there is more to this story.

Moving online ≠ buying online

It’s easy to conflate behaviours moving online with purchasing moving online. Online shopping has seen substantial growth in 2020 driven by the pandemic, but what’s overlooked is the equally dramatic growth in local search.

What’s often overlooked is the dramatic growth in local search.

At NearSt we’ve been monitoring the volume of local product searches going through our platform since mid-2019. It’s a measure of people seeking to find products in local stores that are showing in-store inventory in places like Google.

Using search volumes in mid-February as a pre-pandemic baseline, we see a similar and sustained behaviour shift to that observed in online shopping:

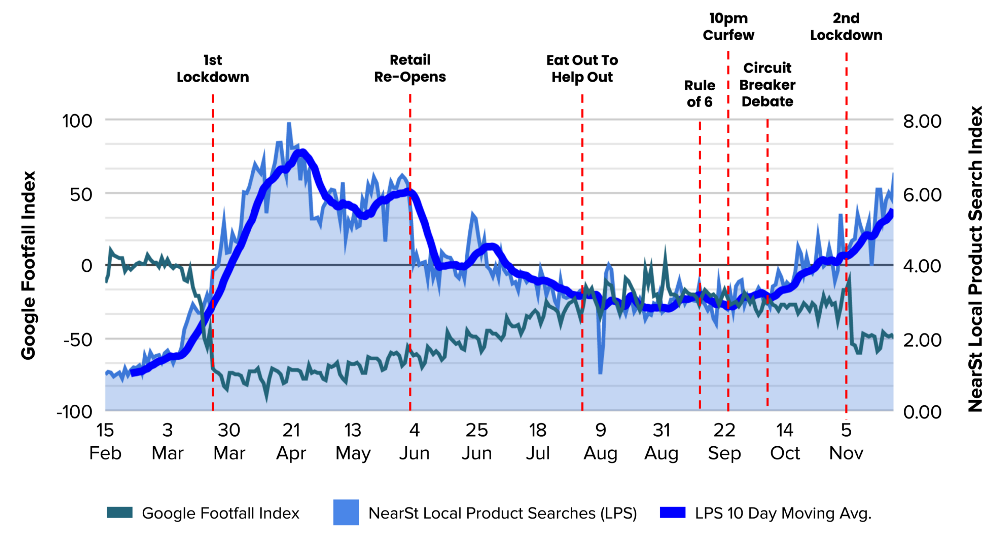

Zooming in on 2020 and the events that have shaped the year, a picture emerges of what’s driving the changes in how people are shopping locally. The chart below also includes Google’s Footfall Index, as a reference point:

NearSt Local Product Search Index and Google Footfall Index in 2020

NearSt Local Product Search Index and Google Footfall Index in 2020The first lockdown drove an almost 8-fold increase in people seeking out product availability information in their local stores, fuelled by uncertainty in almost every aspect of life.

As COVID-cases dropped and much of the economy returned to something resembling normality, local search volumes predictably also reduced. What’s interesting is that they stabilised at 3x the volume we saw pre-pandemic.

This means there’s been a tripling in people going online to find products locally in just five months.

The rise driven by the November-lockdown is also interesting. Shoppers started checking local product availability more often three weeks before the lockdown came in. When we look more closely, news of a possible 2-week “circuit-breaker” lockdown seems to be the trigger for this second rise.

Shoppers want low-effort certainty

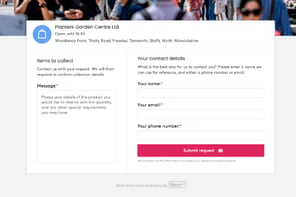

On November 12th, midway through the second nationwide lockdown, we released a simple reservations feature that enables shops without click-and-collect functionality to accept customer reservations.

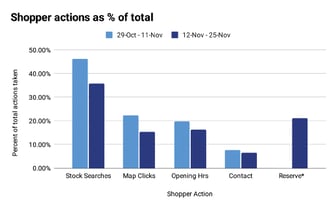

In the two weeks after we released reserve-and-collect, it jumped to over 20% of the total actions shoppers were taking at NearSt shops, second only to completing additional stock searches.

While part of this demand is likely driven by the lockdown, it is still an incredible adoption rate by both shops and shoppers of a very simple but impactful feature.

In the coming months we plan to build on the early success of reserve-and-collect by rolling out Facebook Shops, giving customers the opportunity to browse and reserve products directly on Facebook. We also plan to extend the reservation functionality into Instagram and WhatsApp.

Shoppers are looking for almost anything locally

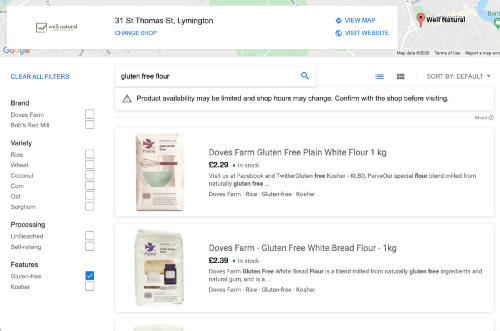

One of the most common misconceptions about local search is that people don’t look for things they know their local shops stock. Looking at data from convenience stores over the most recent lockdown shows that in practice people are checking for particular varieties of everyday essentials.

The top 20 products viewed most often throughout November included Dri Pak Bicarbonate of Soda, Gluten Free Plain White Flour, Bragg Apple Cider Vinegar, Dairy-Free Chocolate Boxes, Organic Puy Lentils, and Quick Yeast.

The common theme throughout is that these are all general products that most shops stock, but with a particular variant to help the shopper confirm if the specific variety they want is in stock. “Organic”, “Dairy-Free”, “Gluten Free”, and brand names were common occurrences throughout the top 20 lists.

What retailers can learn from these changes

1. Uncertainty drives people to check before they travel

This has been clear from the very first lockdown, and has been demonstrated effectively again by the November lockdown. We can extrapolate this out to situations where the potential for a wasted trip would be especially inconvenient, for example in bad weather.

2. Customers are establishing a new expectation of convenience

While life returned to a comparative level of normality over the summer, the sustained increase in shoppers looking for products locally suggests that once customers realise they can easily check local stock, they continue doing so. Whether this be for high end fashion or organic flour.

3. Shopping local, online, is here to stay

As we suggested in our first post in April, the sustained nature of the pandemic combined with retailers adopting tech that helps them serve local shoppers online better, is powerfully habit forming. Once shoppers realise they can shop locally in a much easier way, and retailers are used to offering this, we are unlikely to decommission these new services.

What you can do now

More than half of UK consumers (55%) prefer to buy local brands*, and the pandemic is driving a shift towards both online and local. To benefit from this, brick-and-mortar retailers need to ensure their products are in the places their customers are looking for them.

Making sure your products are found in places like Google and Facebook requires specialist knowledge and tech to deliver a seamless shopper experience. Drop us a line on hello@near.st or visit near.st to find out how we can help.

Other helpful resources from NearSt

- See where your products can appear across Google for free

- Making the most out of your online presence during COVID-restrictions

- Communicating with customers via WhatsApp

- See popular products with local customers in your industry

*IRI European Shopper Insights Survey (2018)